In today’s economy, it’s not easy to come up with extra money when you need it. If you find yourself in a bind and need cash fast, you may be wondering, “How can I get quick cash today?” There are a few ways to get your hands on some quick cash. You could take out a loan, sell some belongings, or ask family and friends for help. However, one of the quickest and easiest ways to get cash is to use a payday loan.

Payday loans are short-term loans that are typically due on your next payday. They are typically for smaller amounts of money, and the interest rates and fees can be high. However, they can be a great option if you need cash quickly and have a limited credit history.

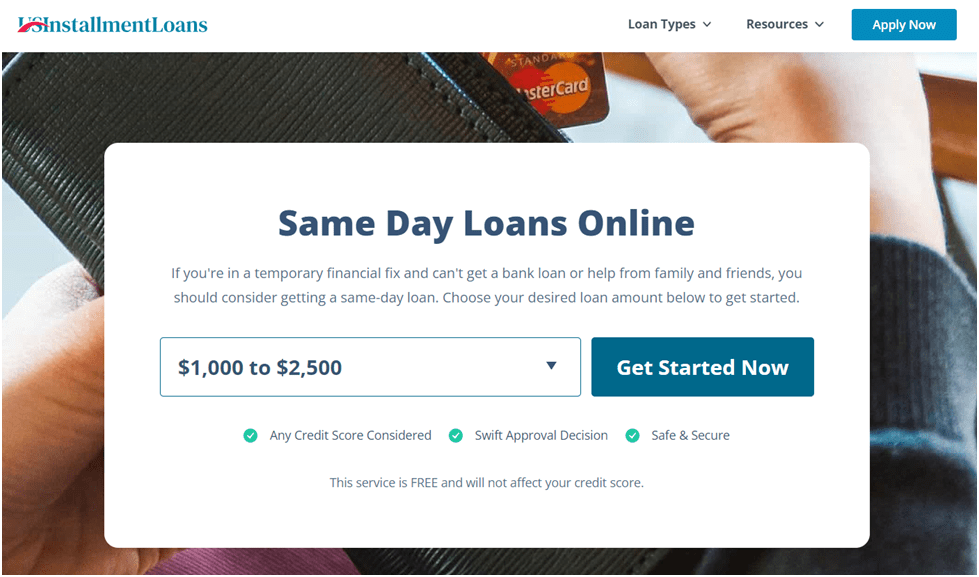

To qualify for a payday loan from an online lending service like US Installment Loans, you’ll need to provide some basic information, such as your name, address, and phone number. You’ll also need to provide proof of income and employment. Once you’ve been approved for a loan, the money will be deposited into your bank account within one business day.

If you’re looking to get same day cash loans here, a payday loan may be the right option for you. Be sure to research your options and compare interest rates before applying for a loan. With a little bit of planning, you can get the cash you need to cover your expenses.

When Should I Apply For A Same Day Loan?

When it comes to needing extra cash, timing is everything. You may be asking yourself, “When is the best time to apply for a quick loan?” Well, there is no definitive answer to that question. However, there are some factors to consider when making your decision.

For starters, you’ll want to think about your current financial situation. If you’re already struggling to make ends meet, it might not be the best time to take on more debt. However, if you have a relatively stable income and can afford to make monthly payments, a quick loan via US Installment Loans may be a good option for you.

You’ll also want to consider your credit score. A high credit score will help you qualify for a lower interest rate, so it’s important to keep that in mind. If you know your credit score is less than stellar, you may want to wait until you have a chance to improve it before applying for a loan.

Finally, you’ll want to think about how you plan to use the loan. If you need money for a specific purpose, like a home or car repair, a quick loan may be a good option. However, if you’re just looking to cover your everyday expenses, you may want to consider a different type of loan.

When it comes down to it, there is no one perfect answer to the question of “When is the best time to apply for a quick loan?” It all depends on your individual circumstances. However, by considering these factors, you can make a more informed decision about whether or not a quick loan from US Installment Loans’ partner lenders is right for you.

What Do I Need To Be Eligible For A Same Day Loan?

Borrowers need to meet some eligibility criteria in order to qualify for a quick loan. The most important criterion is that the borrower needs to be at least 18 years of age. Apart from that, the borrower needs to be a citizen or resident of the country where the loan is being taken. The borrower also needs to have a regular source of income and a bank account.

Benefits & Drawbacks Of Same Day Loans

When you need money and don’t want to wait, quick loans can be a lifesaver. They can provide you with the cash you need to cover an emergency expense or get you through a tough financial situation. However, there are also some drawbacks to quick loans that you should be aware of before you apply. The biggest benefit of a quick loan is the speed with which you can get the money you need. Most quick loans can be approved within minutes, and the money can be in your bank account within a day or two. This is a huge advantage over traditional loans, which can take weeks or even months to process.

Another big benefit of quick loans is that they are available to borrowers with a wide range of credit scores. You don’t need a perfect credit score to get a quick loan, and you can still get a competitive interest rate. This is a big advantage over traditional loans, which are often only available to borrowers with excellent credit.

However, there are also some drawbacks to quick loans. The biggest one is the high interest rates that are typically charged. Quick loans can have interest rates that are two or three times higher than those on traditional loans. This can add up quickly and can result in you paying much more for your loan than you intended.

Another downside to quick loans is that they tend to have shorter repayment terms than traditional loans. This means that you will need to pay back your loan sooner, and may have less time to repay it. This can be a problem if you are not able to afford the monthly payments.

Overall, quick loans can be a great option when you need money fast. However, you should be aware of the high interest rates and short lending periods before you apply.

Are Same Day Loans Legal?

When it comes to getting a quick loan, you may be wondering if it’s legal. After all, you don’t want to get into any legal trouble and have to deal with more stress on top of what you’re already going through. Well, the good news is that quick loans are legal in most cases. There are a few things to keep in mind, though, so be sure to do your research before taking out a loan.

First of all, quick loans are typically small loans, which means that you won’t be taking out a huge sum of money. This also means that the interest rates and fees are typically higher than for other types of loans.

Another thing to keep in mind is that quick loans are unsecured loans. This means that you don’t have to put up any collateral, like your home or car, to get the loan.

So, is a quick loan right for you? It depends on your individual situation. Be sure to weigh the pros and cons before deciding whether or not to take out a loan. And if you do decide to go ahead, be sure to shop around with US Installment Loans for the best deal.